Madan shrestha

The banking sector is currently going through a challenging period in its history. Banks and financial institutions continue to fall unexpectedly. Investors in the banking sector are gradually trying to exit in search of safer investment areas. Various problems are increasing in the banking sectors due to the increased costs, reduction in profit, increase in bad loans, or non-performing loans. There have been raised problems and challenges after another serious question.

Observing the banking market, there is increasing non-performing loans is the main concern and issue for the financial institutions. Banking sectors have focused on how to reduce the non-performing loans is the main concerned. Non-performing loan collection is becoming challenging. Excess liquidity in banks and increasing bad debt have become major challenges for entire banks. Banks are trying to recover bad loans but are not able to collect them as per the targeted plan. Bad debts are increasing day by day. The task of recovering loans has become challenging due to the spread of misunderstandings by some social activists that bank loans do not have to be paid.

Various loan recovery cases have been pending in the debt recovery tribunal for a long time. Banks must maintain the provision as per the increase in the non-performing loans. When the provision is increased the profit will be decreased.

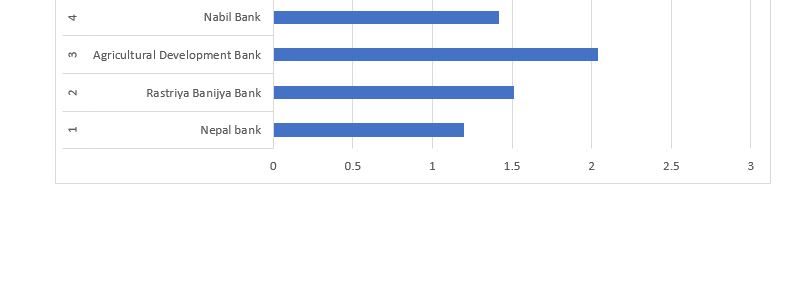

As per Nepal Rastra Bank, Bank Supervision Department Key Financial Indicator of Commercial Banks AS on Asoj end,2081 (Mid-October 2024) the position of NPL of commercial banks is as follows in the chart.

Recently, Karnali Development Bank has declared a problematic position as per Nepal Rastra Bank’s notice of declaration. Nepal Rastra Bank has found that the non-performing loan ratio reached 40.85 % in its inspection. Thus Karnali Development Bank has been declared problematic due to excessive bad loans. It is understood that Nepal Rastra Bank itself failed to monitor, supervise, and regulate all banking sectors in implication in the system.

The recovery of principal and interest on loans taken by borrowers in banks and financial institutions has decreased at a high rate. If the loan cannot recovered on time the financial condition of the bank will be controlled in a negative direction. Therefore, the bank should only provide loans in a way that can be recovered on time.

Demand for all types of loans has been a slowdown from day to day. The credit flow of banks and financial institutions has become very slight. The financial sector is unstable and the trend of the economy is leading to downward. Recently Nepal Rastra Bank absorbed liquidity due to the excess liquidity in the banking system. Nepal Rastra Bank has been continuously withdrawing liquidity since the beginning of the current fiscal year. Financial institutions are suffering from excess liquidity and bad loans.

Financial Indicators of Finance Companies Mid-October 2024, the position of NPL as per Nepal Rastra Bank.

Financial Indicator of Microfinance institutions as on Asoj End, 2081, the position of NPL as per Nepal Rastra Bank.

Political instability, economic slowdown, and decreasing credit demand have negatively impacted the banking industry. Quick fluctuations in liquidity have also threatened the stability of the financial system. So many people worry about the declining economic situation in the country. In the hastily sprouting financial landscape, banks are facing challenges that require them to acclimatize and transform. Banks can run on trust and good relationships with customers. Trust is the groundwork upon which successful banking. Operating banking is very sensitive as compared to other sectors. To meet the needs of the customers banks should deliver proactive, relevant services, connecting with the partners and ecosystem to create better financial outcomes for their customers. These are strategies that banks should follow.

- Banks should use expertise and far deeper customer understandings to enclosure financial services at the customer’s moment of requirement.

- Banks should formulate purposeful strategies, embrace innovation, rethink business models, and deepen their understanding of their customers.

- Banks pursue to develop the customer experience and modernize technology platforms.

According to Cebenoyan and Strahan, 2004, the history of banking has shown that this sector is scrawny to several risks and instabilities, and perhaps it is the only sector of an economy where several risks are managed jointly. In the present time bank stability has become very crucial and instability has risen in entire financial sectors.

There have been many ups and downs in the banking sector. Nepal’s banking sector has come to its present state by overcoming problems of unhealthy competition, weak credit policy, weak institutional good governance, incompetent employees, and others. Technology is changing the entire landscape of banking globally. Banking sectors lack the manpower to handle the growing complexity of modern and international banking transactions.

The banking sector has become a vigorous part of the functioning of the real sector, and its stability is crucial to the health of the whole economy ( NRB, Bank Supervision Report, 2018). Globalization has opened up various opportunities and challenges for Nepalese financial institutions to compete internationally.

Even sectors of the insurance sector have also been impacted by the economic downturn started to affect the insurance sectors. There is a negative relationship between economic improvement and insurance continuity, the numbers of prematurely abandoning insurance increase when the economy declines and decrease when the economy improves.

These are key challenges for the banking sector or financial institutions.

- There is less consistent policy of Nepal Rastra Bank which leads to uncertainty thus regulatory bodies like Nepal Rastra Bank should apply consistent policy.

- The main concern is poor loan recovery rates and defaults contribute to rising non-performing assets thus the entire focus is to be centralized on collecting NPL loans and not to exceed good loans into bad loans.

- Outdated technology must be wiped out because it reduces efficiency.

- Due to the economic fluctuations interest rate fluctuations pose another significant challenge and sudden changes can affect the cost of funds and erode profit margins, leading to instability within the banking system.

- Global competition is getting fiercer and customer expectations are rising as a result of innovation is a great challenge to update locally and globally.

- Banks should promote and update their system and mitigate potential risks, each bank should prepare its own cyber security strategy, and employees need to be trained on cyber security, phishing attacks, and other threats and challenges to maintain customer trust.

- Global economic instability, such as inflation, and recession. Geopolitical tensions can impact to banking sectors thus it is another challenge.

- Another task is to educate customers about financial products and services to foster trust and encourage informed decision-making.

- Banks should focus on reducing costs through automation and process improvements while maintaining competitive pricing strategies for their products.

- Regulatory compliance has become one of the most significant banking industry challenges thus it is to be updated.

- Today’s consumers are smarter, savvier, and more informed than ever before and expect a high degree of personalization and convenience out of their banking experience thus banks should always be customer-friendly.

Banking is facing several challenges in the current economic climate. These challenges range from increased competition and regulatory pressure to changing customer preferences and the emergence of new technology.

Banks should reduce costs by restructuring operations, automating processes, and outstanding functions. Banks should diversify their profit streams by expanding into new markets or products and should build stronger relationships with customers by providing exceptional services and understanding their needs and preferences. The composition of the market in Nepal is very diverse and multicultural ethnicities.

Customer is categorized into various types based on their specific needs, economic activities, and financial behavior and are located in urban, suburban, and remote areas. Banks can overcome these challenges by implementing healthy compliance.